Monday, October 30, 2006

CONDOMINIUM KNOWHOW

Things to remember before you buy it!

Things to remember before you buy it!* Ascertain the cost of replacing your valuables.

* Maintain an inventory and photographs of your personal possessions.

* Upgrade your unit.

* Check if all the measures are worth protecting your liability claims.

* List the valuables insured with special coverage.

* Check the safety features of your unit.

Thursday, September 14, 2006

Social Node Graph for US Insurance

The Social Node Graph assisting the most recent studies across the US depicts a high proportion of the masses to have remained uninsured till date. The figures amount to some 42.6 million in the recent times. This has been the consequence of certain critical conditions which could have been eradicated cheaply through the initial stages. But they have turned into a grave concern for the masses of late by generating an acute health crises and demanding expensive healthcare services or ICU care.

The Social Node Graph assisting the most recent studies across the US depicts a high proportion of the masses to have remained uninsured till date. The figures amount to some 42.6 million in the recent times. This has been the consequence of certain critical conditions which could have been eradicated cheaply through the initial stages. But they have turned into a grave concern for the masses of late by generating an acute health crises and demanding expensive healthcare services or ICU care.Apart from South Africa, the US still remains the only representative of the developed nations, that fails to offer universal coverage to all the citizens. To add to this menace, medical inflation has come up as a big jolt.

There might be a sudden fall in terms of insurance benefits getting awarded to employees or a sharp rise towards their premiums or deductibles.

This unforeseen social turmoil could be explained better with the help of a Social Node graph. Lets get to the Blue node and the Orange node depicted in the above graph. Suppose if the Blue node represents an insurance broker or an insurer,

then he ought to reach the Orange node which would be representing a prospective customer. But as we could see from the graph, there is no direct way to reach out to the Orange node. Therefore the insurer or the broker needs to utilize either the social space or an existing one in order to anchor a new network cable. But in doing so he would be heading towards another dilemma, since the network cable would need the consent of both the parties involved and at the sametime it would be a costly social activity.

Thursday, August 31, 2006

Insurance checks for the DUI convicted

It is usual for most of the insurance companies to check the commuters' motor vehicle records once in three years or whenever a new policy is applied. In case your insurer figures out any DUI conviction involving you, then onwards you would surely feel the burden of higher premium rates or may even face a policy cancellation or nonrenewal. Insurance companies generally follow 2 ways to deal with the customers allegedly involved in DUI. If they discover that you have been involved in DUI they are bound to raise your insurance premiums as also brand you as a high-risk driver. These activities force you to file proof of insurance for three to five years with your motor vehicles State department. In order to prevent your license suspension, your insurance company would need to offer the DMV with an SR-22 form as a proof of insurance to this department. In this case, if your insurance company cancels your insurance for any reason they need to notify this to the DMV as per the SR-22.

It is usual for most of the insurance companies to check the commuters' motor vehicle records once in three years or whenever a new policy is applied. In case your insurer figures out any DUI conviction involving you, then onwards you would surely feel the burden of higher premium rates or may even face a policy cancellation or nonrenewal. Insurance companies generally follow 2 ways to deal with the customers allegedly involved in DUI. If they discover that you have been involved in DUI they are bound to raise your insurance premiums as also brand you as a high-risk driver. These activities force you to file proof of insurance for three to five years with your motor vehicles State department. In order to prevent your license suspension, your insurance company would need to offer the DMV with an SR-22 form as a proof of insurance to this department. In this case, if your insurance company cancels your insurance for any reason they need to notify this to the DMV as per the SR-22.Friday, August 04, 2006

Caregivers affect the Longterm care expenditure

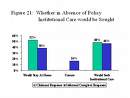

A Family/Informal Caregiver may be described as an individual who provides care and/or support to a physically or mentally disabled family member, friend or neighbour who is suffering from a chronic desease. Now that people are turning away from institutional care with regards to the social diversions and effective policies, it has become more important to get them the much needed care back home or within the communities. There lies a great opportunity for family caregiving. Caregivers are thus playing a key role towards maintaining the home and community care sphere.

A Family/Informal Caregiver may be described as an individual who provides care and/or support to a physically or mentally disabled family member, friend or neighbour who is suffering from a chronic desease. Now that people are turning away from institutional care with regards to the social diversions and effective policies, it has become more important to get them the much needed care back home or within the communities. There lies a great opportunity for family caregiving. Caregivers are thus playing a key role towards maintaining the home and community care sphere.Some 4.6 million senior Americans have been estimated to be in real need of long-term care since they are not confined within nursing homes. The family members and informal caregivers of almost 90% of them are responsible for taking care of their basic daily activities eg. bathing, dressing, fooding as well as other associate activities like cooking, shopping, sweeping etc.

But the recent times have seen the most drastic changes in terms of informal caregiving with more access being passed on to the paid caregivers. This is simply due to the fact that more and more family members are gradually opting out of caregiving. Paid caregivers are capable of maintaining an informal way of caregiving thereby shifting the focus from the numerous nursing home care units.

One of the important factors contributing towards changes in the LTC expenditure growth pattern is the availability of a genuine informal caregiver eg. a spouse caregiver. A reduction of public funding in LTC may see the working women quit jobs and concentrate more on informal care very soon.

Monday, July 24, 2006

Wrap-Up Insurance

A Wrap-Up Insurance program is all about covering the contractors and their subordinates associated with a huge construction project. This policy could be easily procured with the help of an insurance broker and accounts for workers compensation, general liability, and also the immense risks associated with the construction processes. The names of all the contractors and their subordinates usually get enlisted as 'insureds' within such a policy. In order to cater to the long awaiting question of construction defect/general liability claims, the GL-only wrap-ups are now coming up in states with workers' compensation troubles.Planning has therefore become an absolute necessity to see through the success of any wrap-up insurance program. Thus an unforeseen challenge is emerging out of a key success derivative in the form of skillsets aimed at program design, implementation and administration procedures.

A Wrap-Up Insurance program is all about covering the contractors and their subordinates associated with a huge construction project. This policy could be easily procured with the help of an insurance broker and accounts for workers compensation, general liability, and also the immense risks associated with the construction processes. The names of all the contractors and their subordinates usually get enlisted as 'insureds' within such a policy. In order to cater to the long awaiting question of construction defect/general liability claims, the GL-only wrap-ups are now coming up in states with workers' compensation troubles.Planning has therefore become an absolute necessity to see through the success of any wrap-up insurance program. Thus an unforeseen challenge is emerging out of a key success derivative in the form of skillsets aimed at program design, implementation and administration procedures.Friday, July 21, 2006

Get your Flood Insurance !

Flood Insurance is an insurance which offers you coverage for any flood damage. Mostly the insurance companies that take part in the National Flood Insurance Program (NFIP) offer this insurance. NFIP is a joint effort from both the Federal Emergency Management Agency (FEMA) and the private insurance industry. Flood insurance protects you from getting your home and personal belongings damaged by the flood waters. The use of this type of insurance has increased with time since the homeowner policies do not cover for people who reside in places affected by floods.

Flood Insurance is an insurance which offers you coverage for any flood damage. Mostly the insurance companies that take part in the National Flood Insurance Program (NFIP) offer this insurance. NFIP is a joint effort from both the Federal Emergency Management Agency (FEMA) and the private insurance industry. Flood insurance protects you from getting your home and personal belongings damaged by the flood waters. The use of this type of insurance has increased with time since the homeowner policies do not cover for people who reside in places affected by floods.Insurance Quotes know-how

Insurance Quotes are now available online all over the world ! Some of the toppers in this industry are regarded as the pioneers to offer instant insurance estimates. The perfect way to judge a quote from amongst a variety is to look for the one which offers you the best coverage at the cheapest possible price. With the passage of time shopping for the insurance quotes have become easier since it can now be done online. Before you try out purchasing an insurance policy online, see that you compare various online insurance quotes, check and analyze the details of different quotes available. But at the sametime you also need to keep it in mind that while hunting for the cheapest quote you should keep an eye on its quality as well. Thus comparison-shopping online helps you achieve some of the quotes and coverages which in turn helps you determine the best insurance policy for you and your family.

Insurance Quotes are now available online all over the world ! Some of the toppers in this industry are regarded as the pioneers to offer instant insurance estimates. The perfect way to judge a quote from amongst a variety is to look for the one which offers you the best coverage at the cheapest possible price. With the passage of time shopping for the insurance quotes have become easier since it can now be done online. Before you try out purchasing an insurance policy online, see that you compare various online insurance quotes, check and analyze the details of different quotes available. But at the sametime you also need to keep it in mind that while hunting for the cheapest quote you should keep an eye on its quality as well. Thus comparison-shopping online helps you achieve some of the quotes and coverages which in turn helps you determine the best insurance policy for you and your family.Wednesday, July 19, 2006

Keyman Insurance

Keyman Insurance is a form of life insurance affected by a company as an assurance to compensate for any financial loss suffered by the organisation due to the death of a key employee. This insurance only accounts for the benefits stated in the plan of assurance and does not cater to the indemnification of any loss incurred. The growth and prosperity of certain organisations are directly associated with the expertise of their technical support and directors. Thus the organisations are bound to face a financial crisis due to the untimely death of such key employees. But the computation of the exact amount of sum assured is never an easy task. The appropriate amount of such coverage is assumed upon the amount of loss to be suffered by the company in the event of a key employee's death including the expenses that the organisation would incurr towards hiring and training a replacement. Thus we may arrive at the Keyman Compensation Package by assuming it to be ten times the annual compensation [Annual total salary + Bonus + Notional value of perks(Invariable 30% of Annual Salary)] offered to the Keyman as the maximum sum assured under the policy.

Keyman Insurance is a form of life insurance affected by a company as an assurance to compensate for any financial loss suffered by the organisation due to the death of a key employee. This insurance only accounts for the benefits stated in the plan of assurance and does not cater to the indemnification of any loss incurred. The growth and prosperity of certain organisations are directly associated with the expertise of their technical support and directors. Thus the organisations are bound to face a financial crisis due to the untimely death of such key employees. But the computation of the exact amount of sum assured is never an easy task. The appropriate amount of such coverage is assumed upon the amount of loss to be suffered by the company in the event of a key employee's death including the expenses that the organisation would incurr towards hiring and training a replacement. Thus we may arrive at the Keyman Compensation Package by assuming it to be ten times the annual compensation [Annual total salary + Bonus + Notional value of perks(Invariable 30% of Annual Salary)] offered to the Keyman as the maximum sum assured under the policy. Subscribe to Posts [Atom]

We believe in all types of Insurance polices specially in Auto Insurance which help us to get ensure all the safety and security of your luxury Car Stereo system also.Cheap Car Insurance